Your career is on track, your family is on board, and you know you value owning over renting. Now is the time to start the process of buying a home, right?

Maybe — but not before you ensure you’ve thought through this big decision from various angles and perspectives.

Purchasing a home is a complex process and represents a major investment. You need to consider much more than just your ability to buy before you leap into house-hunting.

Plus, you’ll have even more decisions to make once you actually start the home-buying process. The more information you have before you start, the better your decisions will be — which means you need to think through this stuff now, before buying a home.

Below, we’ll explain 5 factors that will help you evaluate your goals, review your finances, and assess the market. With this information in hand, you will be able to decide whether owning a home is the right choice right now for you.

1. What Are the Must-Have Characteristics of a Home You Want to Buy?

Before you begin looking for a home, prepare a list of features you consider absolutely necessary. Make a separate list for characteristics of a home that would be nice to have, but that you could live without.

Is the lack of a garage a deal-breaker for you? What about the quality of nearby schools or the availability of accessible public transportation? Do you need a basement or a big, grassy backyard (or would maintaining those things be unnecessary work for you)?

Think about commute times and potential job changes as you make your list, too. Location, neighborhood, school districts, and so on are important characteristics that will impact your experience of owning the home, but may not be a part of the house itself.

Most online listing websites allow you to sort available homes by various characteristics such as total square footage and number of bathrooms or bedrooms. You can narrow your search ahead of time by eliminating homes that fail to meet your minimum criteria.

2. What Do the Next 5 Years Look Like for You?

As you create your list of must-haves, consider how long you plan to stay in your home once you make your purchase.

If you don’t intend to stay for more than 5 years, then characteristics that affect the home's resale value should be a priority (not necessarily the factors that would make it your ultimate dream home).

You also need to think long and hard if buying a home is even the right move for you if it’s a very short-term living situation. If your job is unstable, or if you want the freedom to move to other cities or states, or if some other reason could make you want to move in less than 5 years, you may be better off renting for now.

That’s because you’re unlikely to recoup the cost of buying a home if you sell it within a couple years of picking up the keys for the first time. And if you’re in any situation where you need the flexibility to move fast, it might be difficult if the market slows down or your home is hard to sell.

If you are making long-term plans, then a home with room for a growing family or an elderly parent may be more important to you than the ultimate resale value. That’s okay, too — just make sure you consider your situation and think about what the next 5 years likely looks like.

3. How Much Cash Do You Have Available?

For most home buyers, the ability to purchase a home depends on their ability to secure a home loan.

A home loan or mortgage allows you to move into your new home long before you’ve saved up the full purchase price. Instead, you pay a portion of the total cost and your lender provides the rest.

That “portion of the total cost” is your down payment. Ideally, you’ll want to put down 20 percent so you only finance 80 percent of the purchase price. This keeps your monthly mortgage payment more manageable and helps you avoid PMI.

While it is possible to obtain loans that cover 95 percent or more of the total purchase price of your home, these loans usually carry other costs and a higher interest rate.

Don’t forget that closing costs associated with a home purchase can add another 2 to 5 percent to the total amount of cash you need to part with at the sale.

When you assess your available funds, plan to include a healthy margin for these extra costs as they can vary.

And remember, when you think about “do I have enough money saved to buy a home?” the answer is likely going to be no if it means draining your emergency savings or retirement fund.

4. Are You Prepared for the Ongoing Costs of Homeownership?

Making the transition from renting to buying a home home (or even from one house to another) can have a significant impact on your budget.

Talking to mortgage lenders and entering numbers into mortgage calculators is helpful but can sometimes leave prospective home buyers with an overly optimistic picture of the future.

Only you can determine what size mortgage you can afford. A common rule of thumb is that your monthly mortgage payment should not exceed about 30% of your monthly income.

Before you decide that this percentage works for your household, review all of your expenses. If you aren’t already tracking your monthly expenditures, start doing so.

As you examine your income and expenses, consider whether you will be able to live comfortably and maintain a reasonable savings rate after your mortgage is paid.

Once you’ve narrowed down your home selection, you’ll want to revisit your budget figures. Look at the home seller’s disclosures to determine whether you’ll be expected to contribute to a homeowners’ association (HOA) and how increases in those fees are determined.

Incorporate any information including local municipal fees, average utility costs, and other expenses into a sample budget.

5. Do You Know Your Credit Score (and Is It Mortgage-Worthy?)

Getting pre-approved for a loan can ensure that you are ready to make a deal when the right house does come along. And checking your credit score in advance of this step can ensure that your credit score is high eneough to buy a home, and that you’ll be eligible for a low interest rate.

Your credit score is part of what helps lenders determine what type of loan, if any, you qualify for. Before you initiate the lender’s credit check process, use one of the many available free credit services to check your score yourself, such as Credit Karma or Credit Sesame.

If your score is less than 740, it might be worth your while to invest some time in improving your credt score before you begin filling out loan applications.

The path to purchasing a home may seem long, but it is just the first step in the homeownership journey.

Well-planned and thought out decisions before you buy will lead you to many happy years as a homeowner. The time you invest now will pay off for years to come.

PLEASE DON'T HESITATE TO CALL ME AT 520-248-1239 OR EMAIL AT grichman@RichmanTucsonHomes.com with any questions and/or to get the ball rolling.

By: Kali Hawlk, Staff Writer, Unison

Other blog entries

• Green Acres Estates, Tucson, Arizona (04/16/2024)• Looking For Relief? Chill Acupuncture And Wellness (04/15/2024)

• Classy Menu, Classy Service: Blue Willow Restaurant (04/09/2024)

• An Antique Dive Bar: The Buffet Bar (03/07/2024)

• Orangewood Estates - A Lovely, Older, NW Tucson Neighborhood (03/05/2024)

• Neighborhood Saloon: Nancy’s Boondocks (03/02/2024)

• Food Court Without The Mall: American Eat Co (02/15/2024)

• Highest Rated Tucson Ebike Dealer: Pedego Tucson (02/10/2024)

• Horror Flick Food: Serial Grillers (02/08/2024)

• Street Tacos and More: Calle Tepa Mexican Street Grill (01/30/2024)

» Blog archive

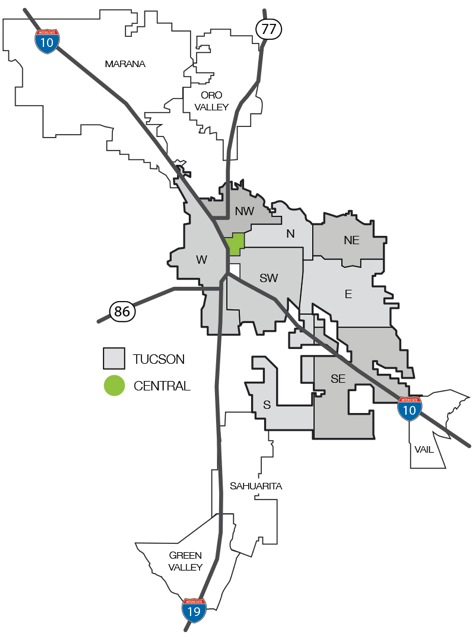

Click on Map to Start Your Tucson Home Search